There has been a longstanding debate whether or not cryptocurrencies have no real value. We hold no illusions in trying to convince anyone from changing how they feel. That said, the value of the cryptocurrency was nearing $3 trillion at the peak in 2021. Now the value of all Bitcoin is over $800 billion and CoinMarketCap shows the value to be $2 trillion as of last look.

What happens if Bitcoin and cryptocurrencies get serious government competition? There is now another view from Wall Street that has some keen insights on how this will all play out for Bitcoin, alt-coins, stablecoins and beyond.

After China banned Bitcoin and cryptocurrencies, there have been underling efforts in the form of (central bank digital currencies. These could become the stablecoins that are discussed routinely, and they could pose a risk to any form of cryptocurrencies. That risk ranges from as little as slim and none all the way to the grave.

So what happens when and if the United States issues its own “Stable Currency” that is a government-backed digital currency (central bank digital currency – CBDC) that is backed just like the U.S. dollar? This is an issue anyone who invests in cryptocurrencies needs to be thinking about. Collectors Dashboard has found a rather insightful research report from Wall Street with some bold predictions, and it highlights what it might mean for Bitcoin and other cryptocurrencies.

Before we get into what is happening with a U.S. CBDC or a Stablecoin, we need to look beyond our borders first. There are some serious lessons to consider that are real-world and are happening real-time!

CHINA, U.K. & EL SALVADOR

It is well documented that China banned Bitcoin and other crypto mining in 2021. China has been in the midst of its own CBDC and China’s digital yuan currency is facing a slow rollout — and China is even giving some away. How this will impact tokens from Alibaba and Tencent remains to be seen.

The Bank of England’s own CBDC is also being explored. That said, the reports we have read indicate that the so-called “Britcoin” is now unlikely to arrive until 2025. Actually, “at least 2025.”

The tiny nation of El Salvador became quite popular among the crypto-fans in 2021 after becoming the first nation to allow widespread Bitcoin transactions at all retail levels and by all of its citizens. The nation’s news coverage of crime and instability suddenly vanished. Now El Salvador’s mining efforts and launch are deemed in a different light because the drop in Bitcoin’s price. The credit ratings agency Moody’s has even chimed in warning that Bitcoin trades are adding to El Salvador’s sovereign credit risks. Moody’s has even warned that the $800 million in bonds maturing in January of 2023 sees an increasing chance that El Salvador will restructure.

DOES A WALL STREET ANALYST KNOW THE U.S. PLANS?

Wall Street analyst upgrades and downgrades have some impact in some cases. Like it or not, that is true. Silvergate Capital Corporation (NYSE: SI) was just removed from the “Best Ideas List” at Wedbush Securities. The firm’s current Outperform rating may still imply significant upside in that stock, but Collectors Dashboard is looking beyond this stock issue into Bitcoin and other cryptocurrencies. Silvergate is one of the key leaders behind crypto infrastructure and it has the Silvergate Exchange Network (SEN).

Here is what Wedbush’s David Chiaverini sees in the Silvergate call that should have a much wider impact. The firm hosted an advisor call on January 7, 2022 with Scott Talbott, who was referred to as a highly respected financial services lobbyist. Talbott is reported to have expressed a view “that the likelihood of the U.S. adopting a central bank digital currency (CBDC) is near 100%.”

Wedbush’s own report warns that this could negatively impact the total addressable market for privately issued stablecoins. This includes Silvergate’s own planned stablecoin. Fortunately for Silvergate, Chiaverini still believes that Silvergate’s leadership position in its high-growth core market of facilitating real-time transfers between crypto hedge funds and crypto exchanges.

Assuming all goes as planned, Silvergate will be the exclusive issuer of the Diem stablecoin. Wedbush warns that it appears as though the likelihood of Diem’s launch has dwindled. The firm also noted that the President’s Working Group recommends that stablecoin issuers should have limited commercial affiliation. That report went on to say:

We had previously believed that the likelihood of a CBDC was slim, given the disruption to the fractional reserve banking system could risk choking off credit to businesses and consumers. However, the structure of the CBDC could look similar to China’s approach, according to Talbott, in which there is a two-tier system that would prevent the CBDC from disintermediating the banking system.

WHAT ABOUT THE FEDERAL RESERVE?

If the U.S. will have a stablecoin, the Federal Reserve has to have a role. That has to be the case. Or does it? According to Wedbush’s Chiaverini, the Federal Reserve would not be the direct access point for the CBDC. His view is that commercial banks would work with the Fed to distribute the U.S. CBDC to consumers and businesses.

Here is why Wedbush says this approach now makes sense:

Talbott believes Chairman Powell may ask Congress to enact legislation that would give the Fed authority to issue a CBDC. Further supporting Mr. Talbott’s view is news that the Boston Federal Reserve is looking to hire a new head of product management for its CBDC pilot program. The Boston Fed has been researching CBDC technology since August 2020 in partnership with MIT’s Digital Currency Initiative.

WHAT ABOUT WHEN?

Launching a CBDC will take time. It cannot happen overnight. Wedbush’s own report even signals that it may take years for a US CBDC to get off the ground. What are other financial sources saying?

The financial website TheStreet.com has noted that Federal Reserve Chairman Jerome Powell will release a report on the benefits of cryptocurrency and a possible CBDC within weeks. Does that mean a few weeks, or longer? Well, this is the government (sort of) we are talking about. Remember, the Federal Reserve is not technically a government agency – but it does have some Congressional oversight and its presidents and chairman are presidential appointments. And if it is not government, that federalresearve.gov domain name could be explained a lot closer. Still, let’s not deviate.

COMPETITION TO STABLE COINS?

Another aspect of what Wedbush Securities warning is that a U.S. CBDC would (“may”) become a significant competitor to privately-issued stablecoins. It turns out that the full might of the Federal Reserve would have an advantage in both distribution and reach. That would bring a crowding out the ability of a “Silver Dollar” to grow at levels that Wedbush had previously anticipated. Chiaverini does still voice that there is some value to private stablecoins:

That said, some stablecoin users may prefer a private stablecoin from a privacy standpoint, and may not want to potentially give up data to government entities. Therefore, we believe SI’s stablecoin opportunity is not completely gone, but curtailed.

AND WHAT ABOUT BITCOIN & OTHERS?

The good news for crypto and stablecoins (and Silvergate) is that Wedbush still sees value in the Silvergate Exchange Network (SEN). On top of being the first of its kind, the report outlines a broader view of the cryptocurrency and digital markets:

Although it is impossible to predict with certainty, we believe that interest in digital currencies by traditional institutions, payment service providers, and retailers should continue to grow over the next several years, and because the SEN is a leader in the space, Silvergate is well-positioned to benefit and drive earnings growth.

Wedbush’s base case is for the price of Bitcoin to remain in an elevated trading range. It’s bullish (upside) case is where bitcoin’s price appreciates, and crypto investing extends to traditional asset manager portfolios. You know the bear (downside case) probably — where Bitcoin loses valuable and credibility.

AND FINALLY…

The reality is that no formal Bitcoin and crypto price targets from HODLrs, Wall Street, and the crypto-haters are assured outcomes. Governments have varied from full support to deep regulations to outright bans. The public is also still quite divided when it comes to their overall opinions about the utility and value of these items.

The debate goes on, but it was interesting to see this sidebar take from an analyst who covers certain stocks.

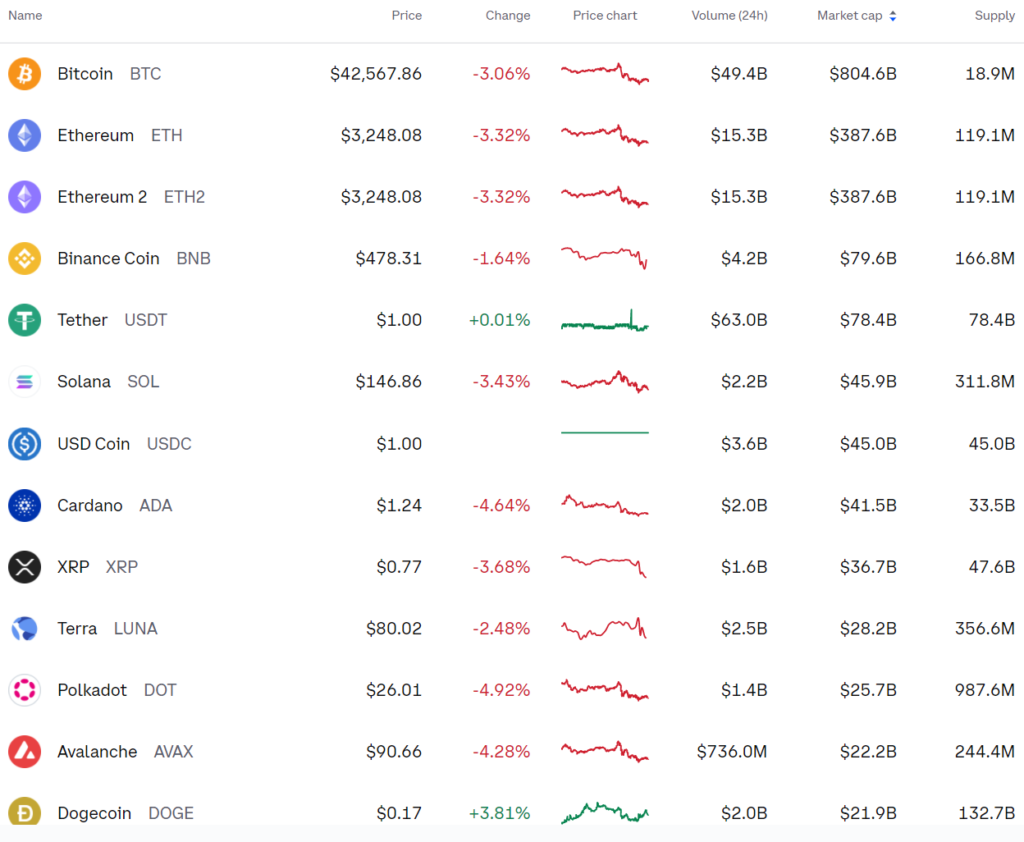

The price of Bitcoin was last seen down 3% at $42,567.85 and the price of Ethereum was last seen down 3.3% at $$3,248.08 on the Coinbase prices sheet. This is a snapshot of the 13 largest cryptos by market cap:

Categories: Digital& NFT